Check out cable TV any night of the week, and you’ll find a home-flipping or renovation reality show. That world seems very alluring – buy a home, put in the work, and reap big profits. Or find a client, throw a fabulous open house, negotiate, and reap the benefits. I’m sold! Sign me up!!

But not so fast little urban planner; investing in residential property whether as a primary residence or investment property – takes know-how and capital. This is where a realtor comes in. A realtor can help any first time buyer or investor navigate the world of real estate and financing. A realtor with investment experience can also help a buyer/investor make a sound financial decision. As cities and communities see resurgence, the real estate market will also grow, creating opportunities for building wealth. So if you’ve ever thought about diving into the world of real estate or investing, this post is for you!

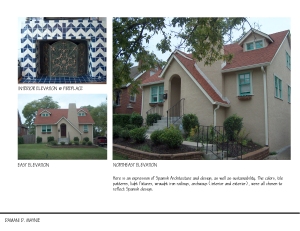

In June, I sat down with realtor and investor Damani Maynie, in an up and coming area of Nashville called Edgehill, to talk about his own adventures in investing. Like many of my CitySpeak interviews, the conversation took a very inspirational turn, as his personal investment experiences revealed some powerful testimonies.

Damani, the city is always speaking. What is it saying to you?

Well, Nashville is becoming a hot place, for professionals and for those in music. And Downtown is really taking off. But even with that progress, we still have a long way to go in terms of becoming a major city. But I think the efforts of this mayor and the past mayor has aided that. So what the city is telling me is that there are many opportunities for new businesses, and for family and individual economic growth. I think there is a market for retail growth within neighborhoods, especially for places on the outskirts of the city. I think Nashville and the inner core has got the idea of walkable neighborhoods, parks, and amenities, but I would like to see more of that in places like Antioch, Hermitage, Mt. Juliet.

So tell me your story, how did you get into the world of real estate and investing?

Well, my stepfather was a contractor. I hung out with him during the summers and did construction work. I did manual labor on older homes but he also gave me the opportunity to design. I also saw an opportunity to make decent money at this; I always had an entrepreneurial spirit, and realized – okay this is something I can do! That’s when I decided to attend TSU (Tennessee State University) to pursue design work. In the meantime I was fortunate enough to secure my first investment and grow from there. So I’ve always loved real estate, investment, and especially design. And in those years I’ve done design, engineering, project management, I’ve invested, and I’ve been a landlord…I’ve done just about everything within the world of real estate! I really enjoy real estate though and my experience allows me to wear many different hats for my clients.

Do you feel any sort of responsibility being an African American realtor? And being African – American what perspective do you bring to your work?

I guess being African American I feel like it’s my duty to share my knowledge with other African Americans that may or may not know about this world. But as far as the profession, I don’t look at myself as just an African American agent because it’s really about offering the best service. Good service is key, and if you have good service you’ll do well. And by good service I mean, being knowledgeable, responsive, and having the ability to guide clients to properties that meet their needs, but that are also sound financial investments. I also have very diverse experiences that I think helps my clients.

Explain that, diverse experiences…

For instance, my investment experience allows me to offer my clients options that can offer equity and room to grow. For example, advising clients to buy a less expensive home and putting in the equity through improvements, instead of buying the home that’s renovated to a ‘tee’ and then paying an arm and a leg for it. And I think this is important in the African American community. Property is a true vehicle to building wealth, for college, retirement.

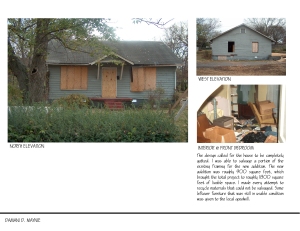

Edgehill Renovation Before – A true fixer upper…

Edgehill Renovation After

Right! For example when I interviewed Will and Sonceria ( “I Live In – An Up and Coming Neighborhood!) I realized that their decision to renovate a home in an up and coming area was a great investment decision…

Absolutely. In many cases these areas were or are still historically black but many blacks living there are renting, while the property owner lives in the suburbs or out of state. So in many cases we are left out of the loop with regard to profit and sales.

So is this a major concern for you with regard to the housing market?

Yes and broadly, gentrification is a concern. And it’s hard for me because I’m also an investor – one of my primary goals is to make a profit. But I can’t invest in places like Brentwood, so I have to invest in places where I can afford to invest; many of those areas are African American. But at the same time I think it’s good to educate the people who live in those areas, because I feel like a lot of people who live in those areas are getting ripped off. I know a lady who sold her house because a parent passed away, and she would call me whenever someone would call her making multiple offers on her home. People need to get educated and know their rights. There isn’t any illegal about doing what I’ve described, but the shady part is what they offer people for their homes.

That’s the tough thing about gentrification, there has to be a willing buyer and a willing seller. So people just need to be educated about the market and the options they may have. I also feel like blacks can help minimize gentrification, by bringing their money and investment to black neighborhoods to maintain the culture and character…

I agree if young blacks did that they could change the inner city. They need to bring their resources to where the resources are – city services, amenities – because that’s what others are attracted to, the city services. Many like that fact that they can walk to the park, to the grocery store, and never have to get in the car! And many people like the suburbs because its family oriented, and there are large lots. However the city is changing, there are family parks, and other family oriented amenities. But the way the city is growing, the Antioch-s and Bellevue-s will continue to grow and those places will become more urban. But all in all, education is extremely important. I try to do that in the communities I work within. I share with owners what their homes are worth, and what other properties have sold for. Just so people are not tricked by investors. I want people to come to the negotiation table educated.

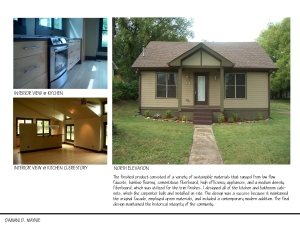

The Urban Pioneer – Damani’s personal home Before…

Damani’s personal home – After

So tell me about your first experience at the negotiation table; your first investment.

My first investment helped me go back to school and focus on that. It paid for school, life, everything – it gave me financial freedom. Now that same investment pays for my personal mortgage, family expenses, and it’s allowed me to dive into my real estate career. But it was a great risk – a divine risk.

So what was that risk like? Were you nervous?

Yea, I was nervous! I had my eye on a small house, but the deed was caught up in the courts. I knew I could flip the house so I could use that money to live on campus. At my age mind you! (Damani was a non-traditional student). So I wanted a small house but I ended up buying a 4 unit apartment building. I walked around it and I walked around it, and the units were boarded up, but I went for it. I sent the owner a letter and he called me and said he’d just prayed about selling the building. And so when we went to closing, I didn’t have enough money at closing. The seller at closing wrote me a check for the difference of $1,500. He said, ‘you know what, I like you, I’m going to sell it to you for what I owe and not make a profit’. He was a black man.

This is similar to Will and Sonceria’s story. They bought the house from a black man in Salemtown who believed in them…

Absolutely, it was divine intervention for sure. I lived in one of the units. And that was the blessing. I was going to live in a small dormitory room, but God gave me a whole building! And this building is the cup that keeps on giving!

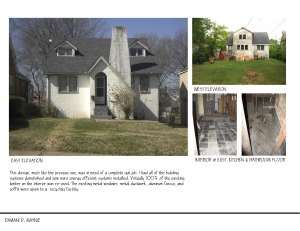

The Building That Keeps on Giving! – Damani’s first investment property

And I knew that I was being led to invest in this property. I was like ‘I have to do it’. But, there was a point when I almost went into foreclosure. I couldn’t rent it. Another investor in the neighborhood, told me ‘man just hold on, it will always rent – don’t worry.’ When he told me that, I had one more month before I was to go into foreclosure. But it finally rented and I never looked back. I knew God didn’t bring me that far to leave me out there like that. It really tests your faith. I was in school, no job and behind on my car payments. But He didn’t leave me. So when I got the opportunity I started buying more.

So what is your goal for your real estate career?

Wow, that’s a big question! At the end of the day, aside from growing my business, I just really want to help people. I have seen how real estate can impact my life, how it helped me, so I just want to help others be successful.

Sold!

Damani is now a full time realtor with Village Real Estate. To contact Damani Maynie visit www.ddm-thepropertyconsultant.com.

Damani’s Real Estate Tips

- Find a realtor that is responsive. Real estate decisions are often emotional and when you find a property you love, you want to act on it immediately. Your realtor needs to be easy to get in touch with.

- When selling your property, make sure you research the market. Don’t fully depend on your tax assessment for property assessments. It’s probably only about 80% of what the property is worth- it’s just for tax purposes. Get a realtor to give you a market analysis. It’s not an appraisal, but it will give you a good sense of what your home could sell for in the market.

- If you are underwater, but can pay the mortgage, keep paying your mortgage. Eventually the value of the home will come back. If you just have to get out, contact the bank because they have options. If you want to sell, a short sale (selling the home for less than what is owed) should be your last option because it could disrupt your credit.

- Keep an open mind. Sometimes your dream home could be a different housing style, location, or a fixer upper. In all cases lean on your realtor to help guide you through the process.

SpeakNow! – Are you a realtor or investor? What tips would you add to this list?